How Money Works Part 1

- August 7, 2024

- Posted by: Dr. Charles Barugahare

- Category: Personal Finance

How money works is necessitated by the reality that in one way or another we all use money. But importantly, we all deal with the key personal finance questions from the time we get to know about money, up to the time we leave this world. There are how we effectively use money, attract, grow, and protect it.

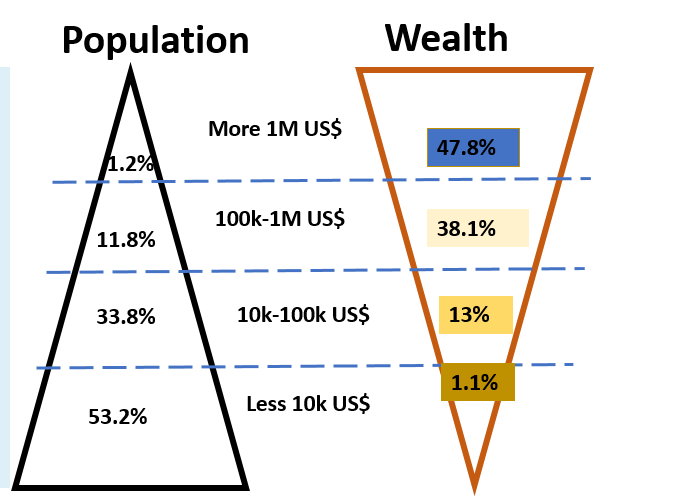

This is a 4-part series of how money works. But before we move deeper into how money works, I want to share a bit of some statistics. The global wealth pyramid for 2021 by James Davies Lluberas and Anthony Shorrocks, Credit Suisse Global Wealth Data 2022 as extracted below shows that 53.2% of the world adult population own 1.1% of the world wealth. To explain this further, they (53.2%) have a net worth of less than USD 10,000 (about UGX 38,000,000) [total assets less total liabilities].

So, the question is where is the 98.9% of the world wealth. Where you fall currently does not matter, because you can steadily and gradually change it. It is within your control if you learn, plan and act differently from today onwards.

Global Adult Population and Wealth Pyramid of 2021

The hard truth is, FinanceLIP like Mother Teresa believes that if you cannot feed 100 people, just feed one. We believe that by providing consistent financial knowledge, we are able then to influence and gradually cause financial improvement. And it is this mindset change that will result in shaping how we earn, spend and then influence our wealth, which ultimately influences our lives. So, if we can make a difference in the financial life of one, two, or more people, we will be satisfied.

How money works has three fundamental pillars, the money foundations, influencers and modalities. This article for focuses on how money works foundations. At an early age, I partly go clue of how money works. While still young, staying with my parents, we used to wake up at 5 a.m. every morning, Monday to Saturday, go to the gardens, and continue with house chores in the afternoon and later in the evening. This forced me to ask my parents why we were working like that, when many others in the community were not working like that.

I got two answers: 1) We work hard to ensure that we can all have food on a sustainable basis, and 2) We work smarter to ensure that you can all go to school. This message did not sink into me at that time, until I was a bit older, and after landing on the quote by Tony Robbins, that “Pain is the ultimate tool for shifting a belief”. That’s when I realized, that my parents structured waking up at 5.00am every day to avoid the pain of hunger or food shortage at home and to ensure that we could all go to school. That’s when I understood partly how money works.

The foundations of how money works looks at two essential aspects absolute desire to earn something for specific purpose(s) and efficient use of it on a sustainable basis. Let’s focus on the absolute desire to earn something for a specific purpose. First things first, you have to appreciate where money is derived from. Money is derived from just two things a good or service. Anyone who provides any of these two with good quality and reasonable quantity will attract money.

Turning to how to create a good or service. Everyone in one way or another, has something unique, called a talent. Some form of skills, which you can build on. Some of the skills we acquired them from parents, some of the skills we acquired them from learning, some of the skills we acquired them through sharing, some of them through practice. And we all have some access to some form of resources.

When I mentioned to some forum that we all in one or the other have some resources, I was almost skinned alive. And that’s when I had to go deeper to explain that most of the resources that make our lives comfortable are free. Air is free and enjoyable to everyone but anyone who converts it into oxygen is able to earn handsomely. Secondly, the sun is free but it is several trillions of dollars’ worth of income to various people through solar power, the solar lighting, and various solar innovations.

So, if we put our talents together, enhance some skills, we can potentially exploit and appreciate the resources around us. It is only then, that we create a valuable good or service.

The price of milk per litre at Uganda national average level is less than 1,200 Uganda shillings at the farm gate. But 100 milligrams cup of yogurt is 1,100 Uganda shillings.

Meaning the price per litre at the farm is equivalent to 100 grams of yogurt. And that is less than half a litre is over UGX 4,500. Colleagues, the only difference here is what they call value, value addition, value addition, value addition.

And we can add value in our skills termed as service. Many people are involved in construction, a porter who earns about UGX10,000 per working day, if he or she adds on some skills, that person shifts from a Porter to a Mason. A mason earns about UGX 30,000 per working day. Which means just by adding that skill, that person more than doubles his or her income. These are what describes the first part of how money works. Watch out for part 2 of how money works.

Dr. Charles Barugahare

FinanceLIP Founder, Director, Author