Currently Empty: UGX 0

Introduction

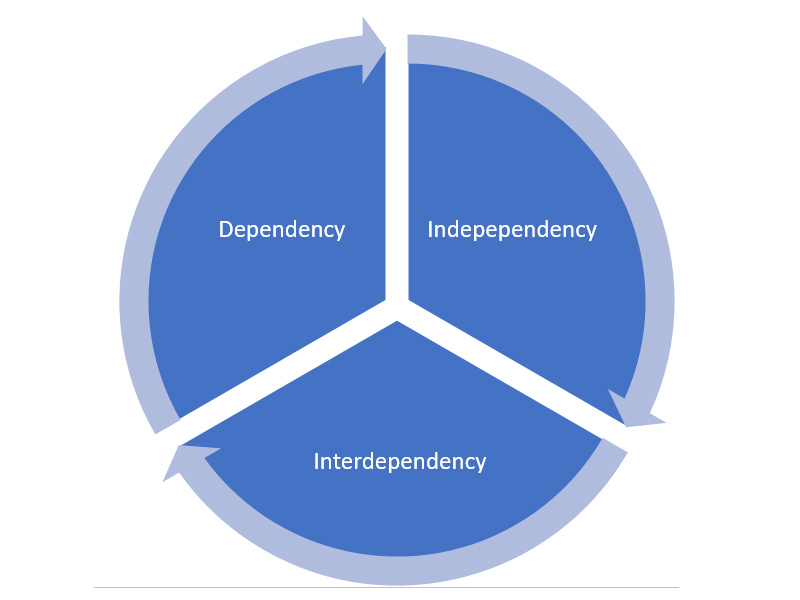

This is the first part in the series of articles of how money plays out in marriage. While growing up, we all wanted to be independent. We wanted to make our own choices and live our own lives. When you get married, does the situation remain the same? This can feel strange at first, just like when we were kids and depended on our parents. You wanted to be independent and move away from dependent lifestyle, right?

Marriage is a journey. It starts with two independent people agreeing to cooporate and live together happily. Two independent people framing how to stay together is a cautious journey with choices. One of being independent while the other turns into a dependent or you both adjust to a new mechanism called interdependence. Is this well appreciated as people get into marriage?

Time flies, it is already 24 years of marriage experience and four years of financial coaching including for couples. The finding so far is that there is limited appreciation of financial relationship in marriage. Research shows that financial problems in marriage are mostly behavioural in nature and they are partly rooted in three key words – Dependent, Independent and Interdependent.

The Dependent Phase

Right from school, individuals are struggling to get out of dependency lifestyle. They want to be free from their parents or guardians control. Each one wants to do his or her things their way. The experience of relying and being under control is seen as a problem that they want to get out of. They push their way out very fast to another level called independent phase.

The Independent Phase

A boy or girl finally gets his or her independence by renting his or her house, apartment or room whatever the case may be. However, it will not take long, this level of independence begins to be boring but also to create some challenges. One starts getting bored staying alone, coming home late, exposed to risky behaviours, eating badly and kikomando almost every day.

Independence begins to be a risk. A boy starts to be visited by a girl friend who wants to stay for a night. Meanwhile the boy is yet not ready for the girlfriend staying the whole night. The reverse is also true, a boy visits a girlfriend and does want to go back home. The girl is stuck with a boyfriend and struggles to find a way out. To mitigate the challenges and threats of independence, thoughts of marriage are ignited. A marriage reunion initiated and actualized. This ordinarily leads us to the interdependence phase.

The Interdependent Phase

The boy and girl who were tired of dependency and independency lives now agree to get into a union of marriage. The question is what relationship will they join now? Ordinarily they are supposed to join an interdependence relationship. This means that they are agreeing that independent living is not good and dependency living is not good either. They have tested both of them and are not working.

In short, they look forward to a better way of living. Interdependence living thus, is a mechanism where both parties agree to capitalize on the strength of each other and gradually working together to minimize or control their individual weaknesses. This kind of relationship will potentially lead to mutual respect, a good environment for an all-round family growth and improvement including financial affairs.

Conclusion

A good understanding of the transition from living a dependent life, to independent life, then to interdependent life becomes the way out. It is however a gradual process and requires knowledge, skills and effort from both partners. It is the appreciation of this journey that lays a strong foundation that supports how money plays out in marriage, without which finances are dealt with from a slippery ground from the start.

Watch out for the next article on financial education in marriage.